Bankruptcy can have a significant impact on your credit score, making it difficult to obtain credit in the future.

But it is possible to repair your credit after bankruptcy. Here are some pointers to get you going:

- Review Your Credit Report: Examining your credit report is the first step in repairing your credit after bankruptcy. Search for any mistakes or discrepancies that can harm your credit score. Any inaccuracies you discover should be disputed with the credit bureau so they may be fixed.

- Budget: Setting up a budget is crucial if you want to repair your credit after bankruptcy. To properly manage your finances, you must be aware of how much money is coming in and leaving out each month. Make a budget that accounts for all of your monthly spending and follow it religiously.

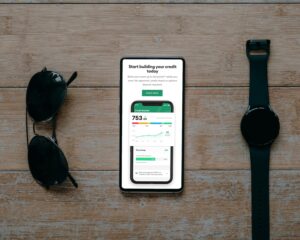

- Rebuild Your Credit: Establishing new credit is one of the greatest strategies to restore your credit after bankruptcy. Take into account getting a secured credit card, which needs a deposit and may assist you in building a solid payment history. You can also think about getting a modest personal loan or adding someone else as an authorized user on your credit card.

- Pay On Time: If you want to restore your credit after bankruptcy, you must make all of your payments on schedule. Make careful to pay your bills on time each month since missed payments may significantly harm your credit score.

- Keep Balances Low: Maintaining a low credit card debt might also aid in raising your credit score. Keep your credit card balance at no more than 30% of your credit limit. High amounts might make it difficult to make timely payments, which can hurt your credit score.

Rebuilding your credit after bankruptcy takes time and effort. However, you can gradually raise your credit score and recover control of your finances by checking your credit report, making a budget, applying for new credit, paying your bills on time, and keeping your balances low.