Your credit score is an important factor in your financial health. Your ability to get loans, credit cards, and even housing can be impacted. It could be challenging to obtain credit authorized or you might have to pay higher interest rates if you have a poor credit score. Fortunately, it is possible to restore credit, and the first step is to comprehend your credit report and score.

Getting to Know Your Credit Report

Your credit report has a thorough history of your credit. It contains details on the credit accounts you have, including credit cards, loans, and mortgages. Additionally, it contains details on your payment history, such as whether you make on-time payments or late payments. Information about any collections or bankruptcies you may have had is also included in your credit report.

It’s crucial to routinely check your credit report to make sure all the information is correct. Errors on your credit report can have a negative impact on your credit score.

Each of the three main credit reporting companies (Equifax, Experian, and TransUnion) is required to provide you with a free credit report once a year.

Knowledge About Your Credit Score

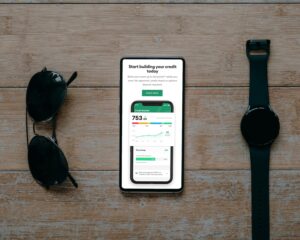

A three-digit figure that measures your creditworthiness is your credit score. It ranges from 300 to 850 and is based on information in your credit report. Your likelihood of receiving favorable interest rates and credit approval increases with your credit score.

Your credit score is dependent on five factors: your payment history, your debts, the duration of your credit history, any new credit you have obtained, and the categories of credit you have utilized. The majority of your credit score, 35%, is based on your payment history.

How to Boost Your Credit Score

There are actions you can take to raise your credit score if it is low. Check your credit report for mistakes and challenge any inconsistencies to get started. As missing or late payments may have a negative effect on your credit score, be sure you are making all of your payments on time.

Pay off loans and credit card bills to lower your debt. Furthermore, you should refrain from creating additional credit accounts unless you really need to. Seeking credit frequently is not good for your credit score.

For credit rehabilitation, it is crucial to understand your credit report and score. Take action to raise your credit score by routinely reviewing your credit report. You may raise your creditworthiness and reach your financial objectives with some time and work.